Estonia has the world’s best tax system

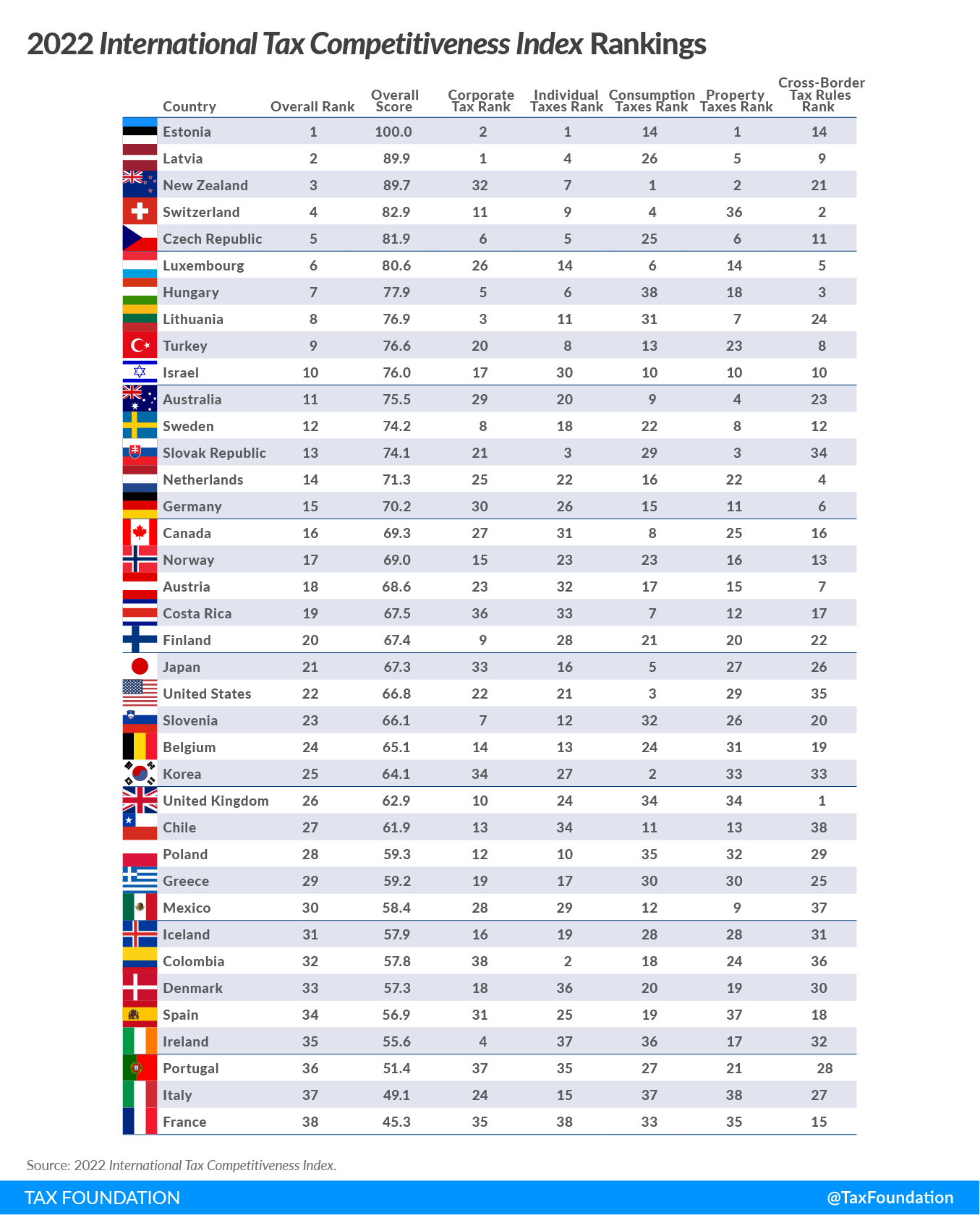

For the ninth year in a row, Estonia has the best tax code in the OECD, according to the Tax Competitiveness Index 2022.

Estonia’s transparent and simple tax system attracts investments with no corporate income tax, no capital tax, and no property transfer taxes according to the report.

According to Tax Foundation, Estonia’s top score in 2022 is driven mainly by four positive features of its tax code:

- It has no corporate income tax on reinvested and retained profits (and a 14-20 per cent corporate income tax rate on distributed profits). This means that Estonia’s corporate income tax system allows companies to reinvest their profits tax-free.

- It has a flat 20 per cent tax on individual income. The tax is not applied in the case of distributed dividends that have already been taxed with a corporate income tax (see above).

- Its property tax applies only to the value of land, rather than to the value of real property or capital.

- It has a territorial tax system that exempts 100 per cent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions.